Ninepoint Focused Global Dividend Fund

December 2023 Commentary

Summary

- Ninepoint Focused Global Dividend Fund had a YTD return of 14.44% up to December 31, compared to the S&P Global 1200 Index's total return of 20.07%.

- In 2023, the Fed's focus was on tightening monetary conditions to combat inflation, which decreased from 9.1% in June 2022 to 3.1% in November 2023 after significant interest rate hikes.

- The Federal Reserve likely concluded its interest rate tightening cycle in 2023 and signaled a shift towards easier monetary policy in 2024 with expected rate cuts.

- The debate centers on whether the Fed can achieve a soft landing for the economy, and while some volatility is expected in early 2024, the market's performance will depend on earnings growth and broadening investment themes.

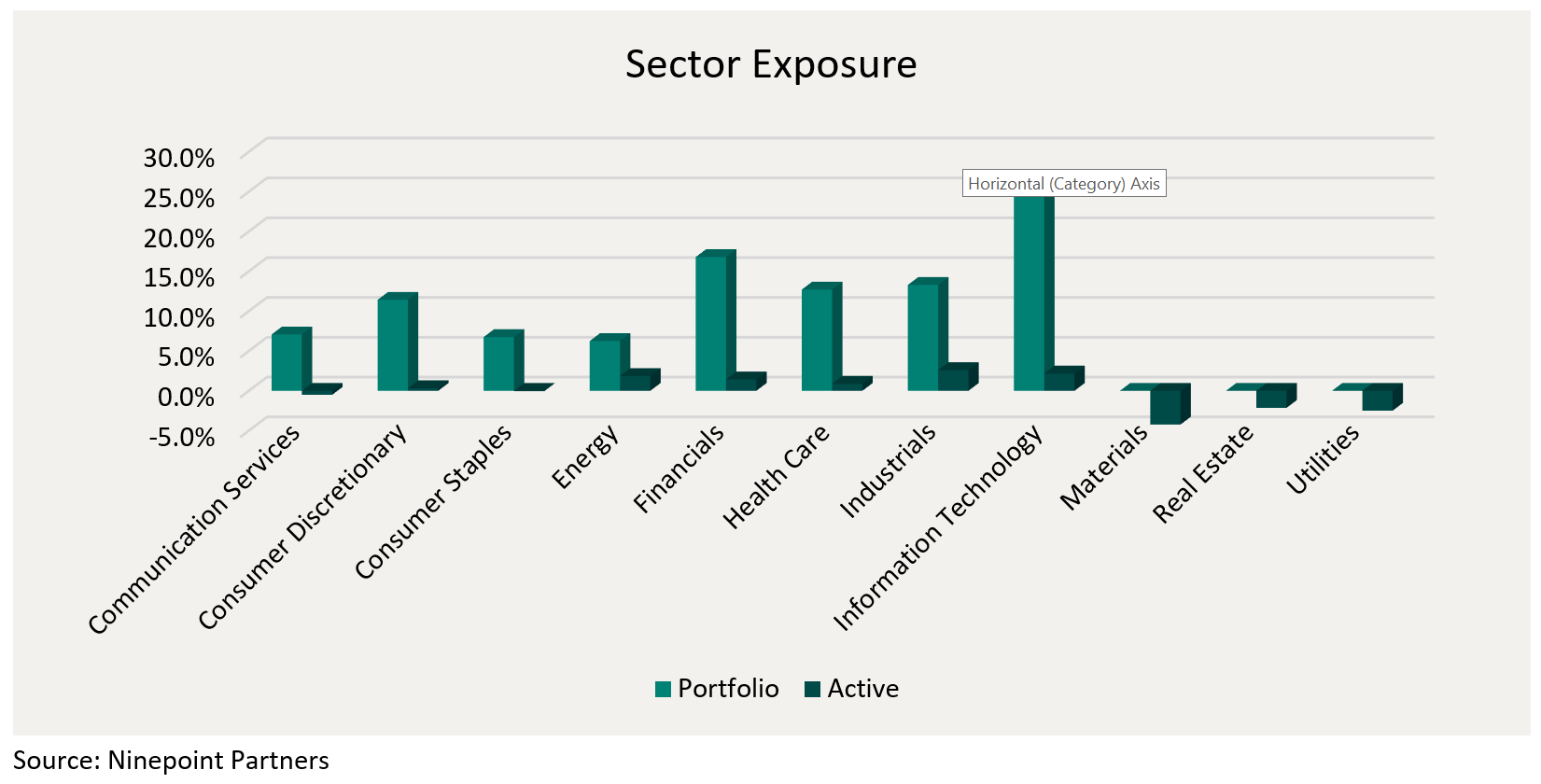

- The Fund is currently overweight the Industrials, Information Technology and Energy sectors, while underweight the Materials, Utilities and Real Estate sectors

- The fund was concentrated in 28 positions, with the top 10 holdings accounting for approximately 41.0% of the fund. Over the prior fiscal year, 19 out of our 28 holdings have announced a dividend increase, with an average hike of 1.6% (median hike of 7.0%)

Monthly Update

Year-to-date to December 31, the Ninepoint Focused Global Dividend Fund generated a total return of 14.44% compared to the S&P Global 1200 Index, which generated a total return of 20.07%. For the month, the Fund generated a total return of 1.84% while the Index generated a total return of 1.89%.

Ninepoint Focused Global Dividend Fund - Compounded Returns¹ As of December 31, 2023 (Series F NPP964) | Inception Date: November 25, 2015

| 1M | YTD | 3M | 6M | 1YR | 3YR | 5YR | Inception | |

| Fund | 1.8% | 14.4% | 7.9% | 7.4% | 14.4% | 6.8% | 9.8% | 7.5% |

| S&P Global 1200 TR (CAD) | 1.9% | 20.1% | 8.5% | 6.8% | 20.1% | 8.9% | 12.3% | 10.3% |

If 2022 was about normalizing interest rate policy, 2023 was all about tightening monetary conditions enough to bring inflation back into line. Considering that US CPI has fallen from 9.1% in June 2022 to 3.1% in November 2023, after 525 bps of tightening, monetary policy seems to have done its job extremely well. But despite the significantly higher rates, growth investors were able to capitalize on a few key investment themes in 2023, including the development of artificial intelligence software to the point of mainstream acceptance (notably large language models for general-purpose queries) and anti-obesity pharmaceuticals (notably the GLP-1 class of drugs). As a result, this past year could be characterized by huge performance disparities at the S&P 500 sector level, with Information Technology (+56%), Communication Services (+54%) and Consumer Discretionary (+40%) leading the pack while Utilities (-10%), Energy (-5%) and Consumer Staples (-2%) bringing up the rear. Unfortunately, dividend paying stocks and real asset-based investments tend to be concentrated in these lagging sectors, nonetheless we are still reasonably pleased with our absolute performance this year.

Through much of the second half of 2023, we became comfortable with the idea that the final interest rate hike in the US had occurred at the July meeting but assumed that Fed officials would continue to talk tough to prevent a loosening of financial conditions and potentially risk resurgent inflation. We also believed that the final spike in the US 10-year bond yields to just above 5.0% last October effectively tightened financial conditions to a sufficient degree to satisfy the FOMC committee members. We expected the Fed to remain data dependent but would take a more balanced view in pursuit of their dual mandate of full employment and price stability. Reassuringly, the December FOMC meeting not only confirmed that the tightening phase of the interest rate cycle was done, but that the Fed was now looking to pivot to easier monetary policy in 2024. Chairman Powell’s press conference was viewed as dovish, and the Summary of Economic Projections indicated a lower terminal rate (consistent with the current range of 5.25% to 5.50%) and three rate cuts (of 25 bps each) in 2024 as opposed to a more hawkish outlook previously forecasted.

The debate now turns to whether the Fed can engineer a soft-landing or whether the lagged impact of 525 bps of tightening will eventually do more serious damage to the US economy. It is perhaps unsurprising that investors cheered the dovishness and continued to push equities higher and bond yields lower in December even after a very good November, given the challenging environment over the past two years. What was surprising to us was the fact that the forward curve almost immediately suggested approximately six rate cuts in 2024. We believe that the 150 bps of anticipated easing in 2024 may not be consistent with a dovish/bullish scenario (growth would likely have to weaken dramatically for that amount of Fed easing, which wouldn’t be particularly good for the equity markets), but we think that only a few rate cuts would be needed to improve the odds of a soft-landing. Conceptually, a few rate cuts will be necessary in 2024 to ensure that real interest rates don’t become more restrictive as inflation expectations continue to fall through the coming year.

Because we are likely close to the first rate cut of the cycle, but the precise timing is unknown and the future economic environment remains uncertain, we should expect some volatility in the first half of 2024. Further, with the S&P 500 finishing the year at 4770 (or almost 20x 2024 forward earnings according to FactSet), it feels like investors have optimistically pulled forward some returns from 2024 into 2023. Therefore, after a flat year of earnings growth in 2023, a return to earnings growth in 2024 (currently forecasted at 10.4%, again according to FactSet) will be required for the market to continue to move much higher from here. However, if the growth materializes and the rally broadens away from the AI-related and GLP-1-related investment themes and mega-cap tech moves sideways or even underperforms in 2024 (quite possible given the high expectations and high multiples already applied to these equities), our dividend focused mandates should do well on both an absolute and relative basis. As always, we are continually searching for companies that are expected to post solid revenue, earnings and dividend growth but still trade at acceptable valuations today.

For the Ninepoint Focused Global Dividend Fund, we are concentrating our research efforts on high quality, dividend growth companies given our positive assessment of the risk/reward outlook over the next few years. After assessing relative valuation and earnings growth expectations, we are particularly interested in the equities in the Financials, Health Care, Industrials and Energy sectors and expect our positioning to reflect this view very early this year. After many years of outperformance from the high growth and high valuation Information Technology sector, if interest rates fall and earnings growth becomes more widespread, we would expect a rotation out of the big winners of 2023 and into undervalued equities more aligned with our dividend-focused mandates in 2024.

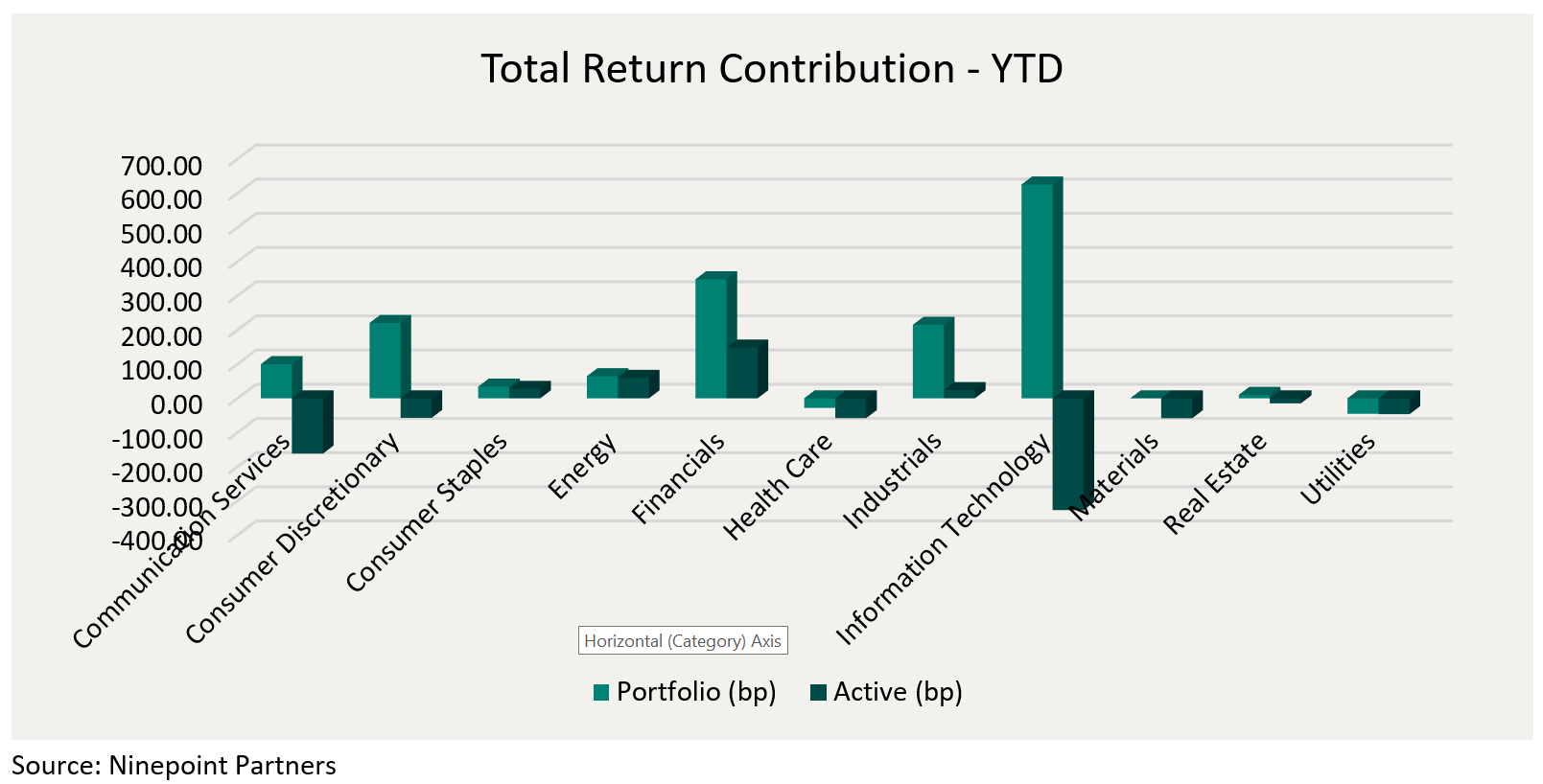

Top contributors to the year-to-date performance of the Ninepoint Focused Global Dividend Fund by sector included Information Technology (+625 bps), Financials (+348 bps) and Consumer Discretionary (+220 bps), while top detractors by sector included Utilities (-45 bps) and Health Care (-28 bps) on an absolute basis.

On a relative basis, positive return contributions from the Financials (+148 bps), Energy (+60 bps) and Consumer Staples (+28 bps) sectors were offset by negative contributions from the Information Technology (-327 bps), Communication (-162 bps) and Materials (-58 bps) sectors.

We are currently overweight the Industrials, Information Technology and Energy sectors, while underweight the Materials, Utilities and Real Estate sectors. Although the lagged impact of monetary tightening is now slowing inflation, constraining growth, and creating higher unemployment, we expect a pivot to easier monetary policy at some point in 2024. In the meantime, we remain focused on high quality, dividend payers that have demonstrated the ability to consistently generate revenue and earnings growth through the business cycle.

The Ninepoint Focused Global Dividend Fund was concentrated in 28 positions as at December 31, 2023 with the top 10 holdings accounting for approximately 43.0% of the fund. Over the prior fiscal year, 19 out of our 28 holdings have announced a dividend increase, with an average hike of 1.6% (median hike of 7.0%). We will continue to apply a disciplined investment process, balancing various quality and valuation metrics, in an effort to generate solid risk-adjusted returns.

Jeffery Sayer, CFA

Ninepoint Partners

1 All returns and fund details are a) based on Series F shares; b) net of fees; c) annualized if period is greater than one year; d) as at December 31, 2023; e) 2015 annual returns are from 11/25/15 to 12/31/15. The index is S&P GLOBAL 1200 TR (CAD) and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: ADR risk; Capital depletion risk; Concentration risk; Credit risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded funds risk; Foreign investment risk; Inflation risk; Interest rate risk; Liquidity risk; Market risk; Rule 144A and other exempted securities risk; Securities lending, Repurchase and reverse repurchase transactions risk; Series risk; Short selling risk; Specific issuer risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended December 31, 2023 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/ or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering or tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on the specific circumstances before taking any action.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Focused Global Dividend Fund 11/2023

- Focused Global Dividend Fund 10/2023

- Focused Global Dividend Fund 09/2023

- Focused Global Dividend Fund 08/2023

- Focused Global Dividend Fund 07/2023

- Focused Global Dividend Fund 06/2023

- Jeff Sayer - H1 2023 Market Review and Outlook - Focused Global Dividend Fund

- Focused Global Dividend Fund 05/2023

- Focused Global Dividend Fund 04/2023

- Focused Global Dividend Fund 03/2023

- Focused Global Dividend Fund 02/2023

- Focused Global Dividend Fund 01/2023