Ninepoint Focused Global Dividend Fund

July 2023 Commentary

Summary

- The Ninepoint Focused Global Dividend Fund generated a total return of 8.30% compared to the S&P Global 1200 Index, which generated a total return of 15.40%.

- The AI-related investment theme has driven strong year-to-date results, primarily fueled by multiple-expansion.

- Q2 earnings season shows better-than-expected results (5.2% decline vs. projected 8-9% decline).

- Positive EPS surprises and better-than-expected earnings decline contribute to a potential catch-up scenario for stocks, even if headline indexes remain stable or decline.

- Sectors like Consumer Staples, Energy, Financials, Health Care, Real Estate, and Utilities are being monitored for potential outperformance.

- The Fed's 525 basis point rate hikes likely mark the end of the tightening cycle; inflation peaked at 9.1% in June 2022 and was at 3.0% June 2023 in a year-over-year basis.

- The fund was concentrated in 30 positions. Over the prior fiscal year, 23 out of our 30 holdings have announced a dividend increase, with an average hike of 12.2% (median hike of 8.6%).

Monthly Update

Year-to-date to July 31, the Ninepoint Focused Global Dividend Fund generated a total return of 8.30% compared to the S&P Global 1200 Index, which generated a total return of 15.40%. For the month, the Fund generated a total return of 1.65% while the Index generated a total return of 2.68%.

Ninepoint Focused Global Dividend Fund - Compounded Returns¹ As of July 31, 2023 (Series F NPP964) | Inception Date: November 25, 2015

| 1M | YTD | 3M | 6M | 1YR | 3YR | 5YR | Inception | |

| Fund | 1.7% | 8.3% | 1.6% | 7.2% | 11.3% | 7.0% | 6.3% | 7.1% |

| S&P Global 1200 TR (CAD) | 2.7% | 15.4% | 5.2% | 9.3% | 17.1% | 11.5% | 9.9% | 10.4% |

Stocks can move higher for many reasons, but, fundamentally, multiple-expansion or earnings growth (or a virtuous cycle of both occurring simultaneously), are required for capital appreciation. Investors in the AI-related investment theme have been rewarded with solid results year-to-date (powered by multiple-expansion) while most other investment opportunities have lagged. As the Q2 earnings season winds down, with 84% of the S&P 500 having reported actual results, 79% of companies have posted a positive EPS surprise. According to FactSet, the blended year-over-year earnings decline is 5.2%, admittedly down, but much better than initial expectations for a decline of somewhere between 8% to 9%. If the Q2 proves to be the earnings trough (consistent with current consensus estimates), we could see more stocks play “catch-up” even if the headline indexes move sideways or drift lower as earnings growth reaccelerates. In this environment, our job will be to find the companies that are posting solid earnings growth at acceptable valuations to generate long-term gains. Steady dividend payers and real asset strategies look poised to benefit from any rotation out of the high-multiple, technology winners of 2023.

Importantly, after 525 basis points of Fed interest rate hikes since March 2022, we believe that we are now at the very end of the tightening cycle. Inflation peaked in June 2022 at 9.1% and has steadily trended lower, to 3.0% in June (on a year-over-year basis). Although this most recent data point is above the Fed’s official target of 2.0% inflation, Chairman Powell acknowledged that tightening until an actual 2.0% CPI reading would be inappropriate due to the lagged effect of higher rates. In the near term, while Fed FOMC members may continue to talk tough about inflation (and rightly so, to prevent rampant speculation fueled by incremental leverage), we think the pause becomes permanent. We still don’t expect a pivot to easier monetary policy in 2023, however, we do believe that the end of the tightening cycle would allow some of the lagging sectors to lead over the balance of the year. We are particularly watching select names in the Consumer Staples, Energy, Financials, Health Care, Real Estate, and Utilities sectors, specifically those with solid dividend payouts, that have mostly underperformed year-to-date.

In an environment of moderating inflation but slowing growth through 2023, the most important drivers of investment performance will likely be valuation, balance sheet strength and the ability to consistently generate cash flow and earnings. Should the year-to-date rally broaden beyond everything related to the AI trade, a rotation into high quality, dividend payers would result in better relative performance from our strategies going forward. In keeping with our mandates, we are concentrating our efforts on free cash flow positive, high quality, dividend growth companies and real asset investments given our positive assessment of the risk/reward outlook over the next two to three years.

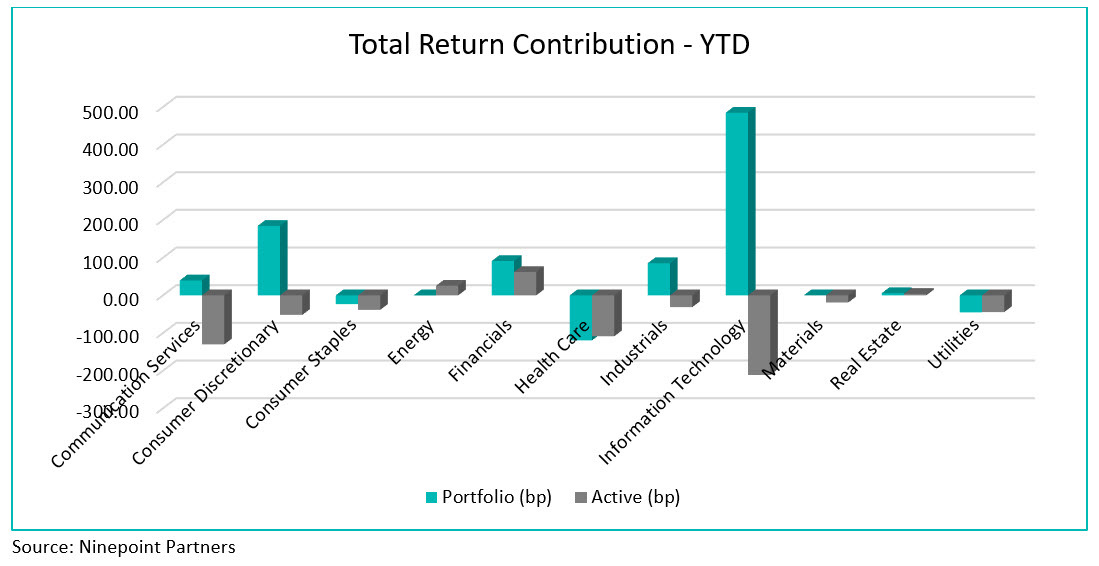

Top contributors to the year-to-date performance of the Ninepoint Focused Global Dividend Fund by sector included Information Technology (+482 bps), Consumer Discretionary (+165 bps) and Financials (+148 bps) while top detractors by sector included Health Care (-116 bps) and Utilities (-45 bps) on an absolute basis.

On a relative basis, positive return contributions from the Energy (+80 bps), Financials (+49 bps) and Real Estate (+4 bps) sectors were offset by negative contributions from the Information Technology (-263 bps), Communication (-150 bps) and Health Care (-118 bps) sectors.

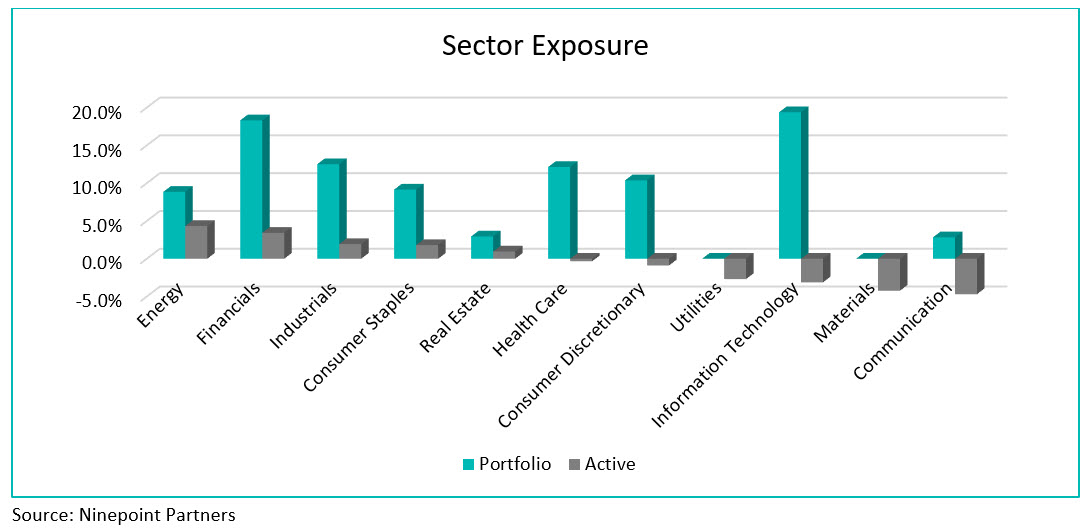

We are currently overweight the Energy, Consumer Staples, and Consumer Discretionary sectors, while underweight the Materials, Communication and Utilities sectors. We continue to believe that we are at the end of the tightening cycle as inflation continues to trend lower and the unemployment rate begins to move higher. So, while we work through the late stages of one of the most highly anticipated downturns ever, we remain focused on high quality, dividend payers that have demonstrated the ability to consistently generate revenue and earnings growth through the cycle.

The Ninepoint Focused Global Dividend Fund was concentrated in 30 positions as at July 31, 2023 with the top 10 holdings accounting for approximately 38.3% of the fund. Over the prior fiscal year, 23 out of our 30 holdings have announced a dividend increase, with an average hike of 12.2% (median hike of 8.6%). We will continue to apply a disciplined investment process, balancing various quality and valuation metrics, in an effort to generate solid risk-adjusted returns.

Jeffery Sayer, CFA

Ninepoint Partners

1 All returns and fund details are a) based on Series F shares; b) net of fees; c) annualized if period is greater than one year; d) as at July 31, 2023; e) 2015 annual returns are from 11/25/15 to 12/31/15. The index is S&P GLOBAL 1200 TR (CAD) and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: ADR risk; Capital depletion risk; Concentration risk; Credit risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded funds risk; Foreign investment risk; Inflation risk; Interest rate risk; Liquidity risk; Market risk; Rule 144A and other exempted securities risk; Securities lending, Repurchase and reverse repurchase transactions risk; Series risk; Short selling risk; Specific issuer risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended July 31, 2023 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners LP. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners LP is or will be invested. Ninepoint Partners LP and/ or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering or tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on the specific circumstances before taking any action.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Focused Global Dividend Fund 12/2023

- Focused Global Dividend Fund 11/2023

- Focused Global Dividend Fund 10/2023

- Focused Global Dividend Fund 09/2023

- Focused Global Dividend Fund 08/2023

- Focused Global Dividend Fund 06/2023

- Jeff Sayer - H1 2023 Market Review and Outlook - Focused Global Dividend Fund

- Focused Global Dividend Fund 05/2023

- Focused Global Dividend Fund 04/2023

- Focused Global Dividend Fund 03/2023

- Focused Global Dividend Fund 02/2023

- Focused Global Dividend Fund 01/2023