Ninepoint Alternative Health Fund

March 2024 Commentary

Summary

The Fund’s performance in March (+8.0%) was driven by continued enthusiasm for several near-term catalysts taking place in the US cannabis industry. US cannabis investors received some welcomed news on March 7th when President Biden, during the State of the Union address, discussed federal cannabis reforms. This near-term catalyst, outlined below, is a key component of regulatory reform, and, if implemented, would lead to cash flow enhancement and significantly higher equity value for the US cannabis industry. The second announcement supporting cannabis equities during the month involved state-level catalysts that directly impact specific operators that have exposure to Florida as investors waited for a ruling from the Florida Supreme Court. Globally, Germany legalized adult use cannabis in a very limited form, and although a major European country legalizing cannabis is a positive step, the limitations around the legislation leave us unsure of the near-term growth potential. On the healthcare side of the portfolio, we discuss recent quarterly results from Costco Wholesale Corp which continues to generate strength in health and wellness offerings. In addition, this month’s commentary provides insights into our position in UnitedHealth Group (UNH) and how our option writing program assists us in building our position patiently and taking advantage of volatility spikes.

Ninepoint Alternative Health Fund - Compounded Returns¹ as of March 31, 2024 (Series F NPP5421) | Inception Date - August 4, 2017

| MTD | YTD | 3MTH | 6MTH | 1YR | 3YR | 5YR | ANNUALIZED (INCEPTION) | |

| FUND | 8.0% | 23.6% | 23.6% | 21.5% | 28.6% | -15.7% | -6.9% | 7.5% |

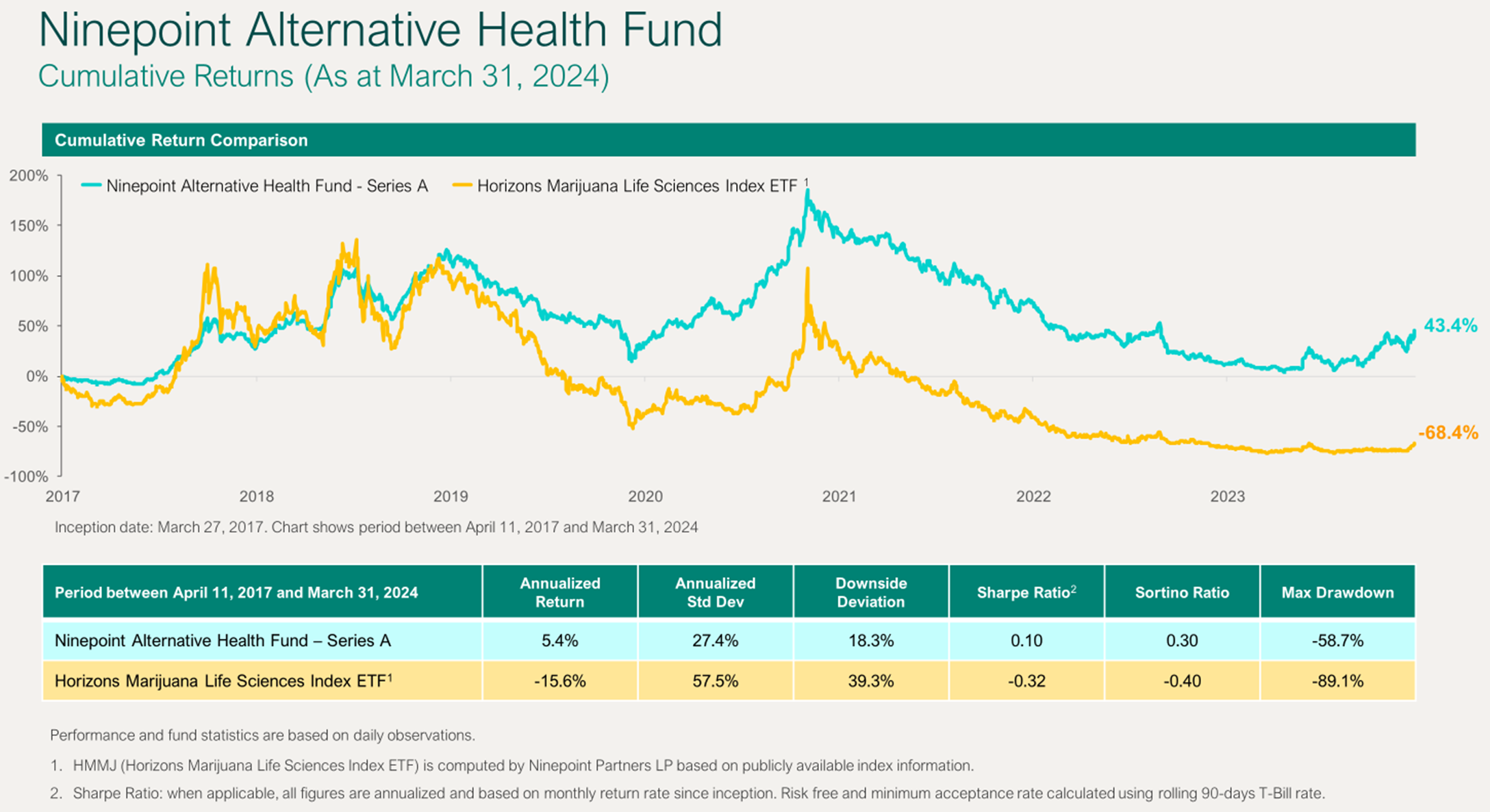

The Fund continues to provide outperformance relative to its benchmark and has done so over the last five + years. Names with a strong performance in March were within our US cannabis names including; VRNO + 26.30%, TRUL +22.50%, GTII +16.25% and TSND + 16.17%.

The State of the Union

On March 7th, US President Joe Biden presented his State of the Union to the American people which during an election year is also seen as a platform upon which the President will run for re-election. It was noteworthy for the cannabis sector as in this SOTU, the President discussed cannabis reform outlining White House efforts to reschedule cannabis at the federal level as well as the pardons that have been issued for those incarcerated at the federal level for possession of cannabis. This is significant as it was the first time in US history that the President discussed cannabis during the SOTU. The quote that stood out from his address was “No one should be jailed for simply using or having it on their record”. He went further to state that he would be “directing Cabinet to review the federal classification of marijuana.” This is a direct suggestion with respect to his previous request to re-schedule cannabis, with The Department of Health & Human Services (HHS) already supporting a Level III re-classification on the Controlled Substances Act (CSA). Industry watchers are waiting for the DEA to make a similar determination. As we have noted in previous commentaries, this is significant as a re-scheduling to Schedule III would remove the punitive IRS Tax 280E that hampers cannabis companies in the US.

Recent Gallup polls show that approximately 70% of Americans think cannabis use should be legal. Further pressure was put on the DEA to make its decision in favour of a Schedule III re-classification by the Vice President one week later. Vice President Kamala Harris stated “I can’t emphasize enough, they need to get to it as quickly as possible” noting the confusing classification of narcotics such as heroin as a Schedule I drug, fentanyl as a Schedule II drug, both linked to tens of thousands of deaths, whereas cannabis is a Schedule I drug with HHS stating it has a low risk of abuse in addition to medical evidence to support various ailments. The Biden Administration wants this favourable outcome and wants it to come out soon so that it can be used as an election platform.

Source: https://news.gallup.com/poll/514007/grassroots-support-legalizing-marijuana-hits-record.aspx

The Sunshine State

The next near-term catalyst that has been driving names higher during March was focused on the state of Florida. By April 1st, The Florida Supreme Court had to make a decision on whether or not to accept a move by state Attorney General Ashley Moody (R) to invalidate the ballot initiative measure that would prevent Floridians from voting on converting Florida to a recreational state market. At issue was the proposed language to be used on the ballot and whether it met the state’s constitutional language limitations. On Monday, April 1st at 4 pm, the court issued its decision approving the language and allowing the vote to take place.

Some background on how we got here:

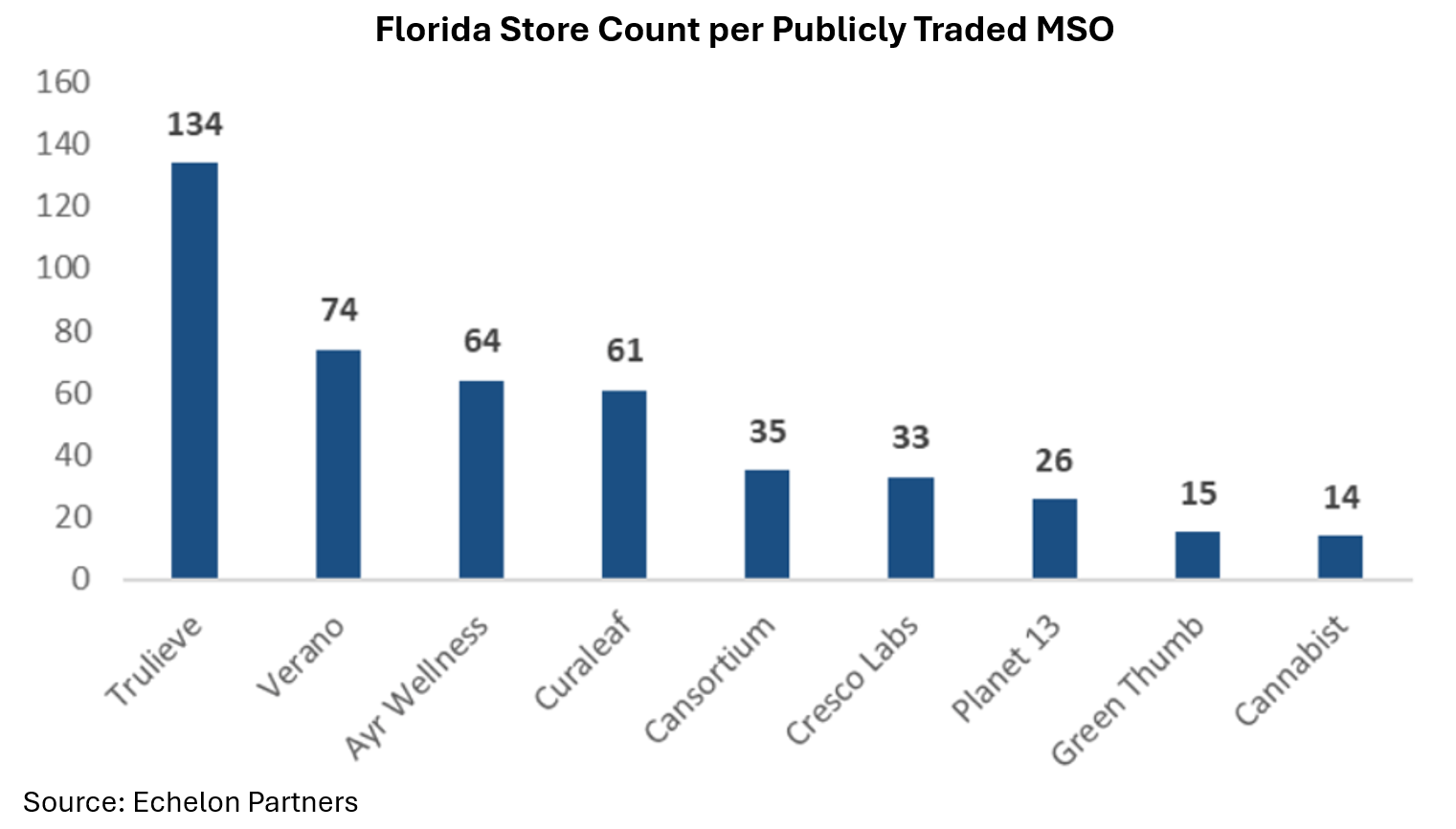

It has been well documented that Gov. Ron DeSantis (Republican) and the FL Republican-controlled legislature have been against legalization, to the point of refusing to debate the legalities or rules of operation for state-run cannabis companies. In Florida, the mechanism that voters have to get approval for state-level changes despite legislative roadblocks is to have a signature campaign, that leads to a Florida Supreme Court decision. Back in 2021, language was found to be misleading by the Court blocking any chance of moving forward in 2022. This time around, the Florida Smart & Safe group leading the campaign ensured more than enough signatures and had language acceptable to the Court. Trulieve Cannabis (TRUL), the operator that has a dominant market position in FL supported Florida Safe & Smart with at least $40 million to ensure proper signature collection and legal representation.

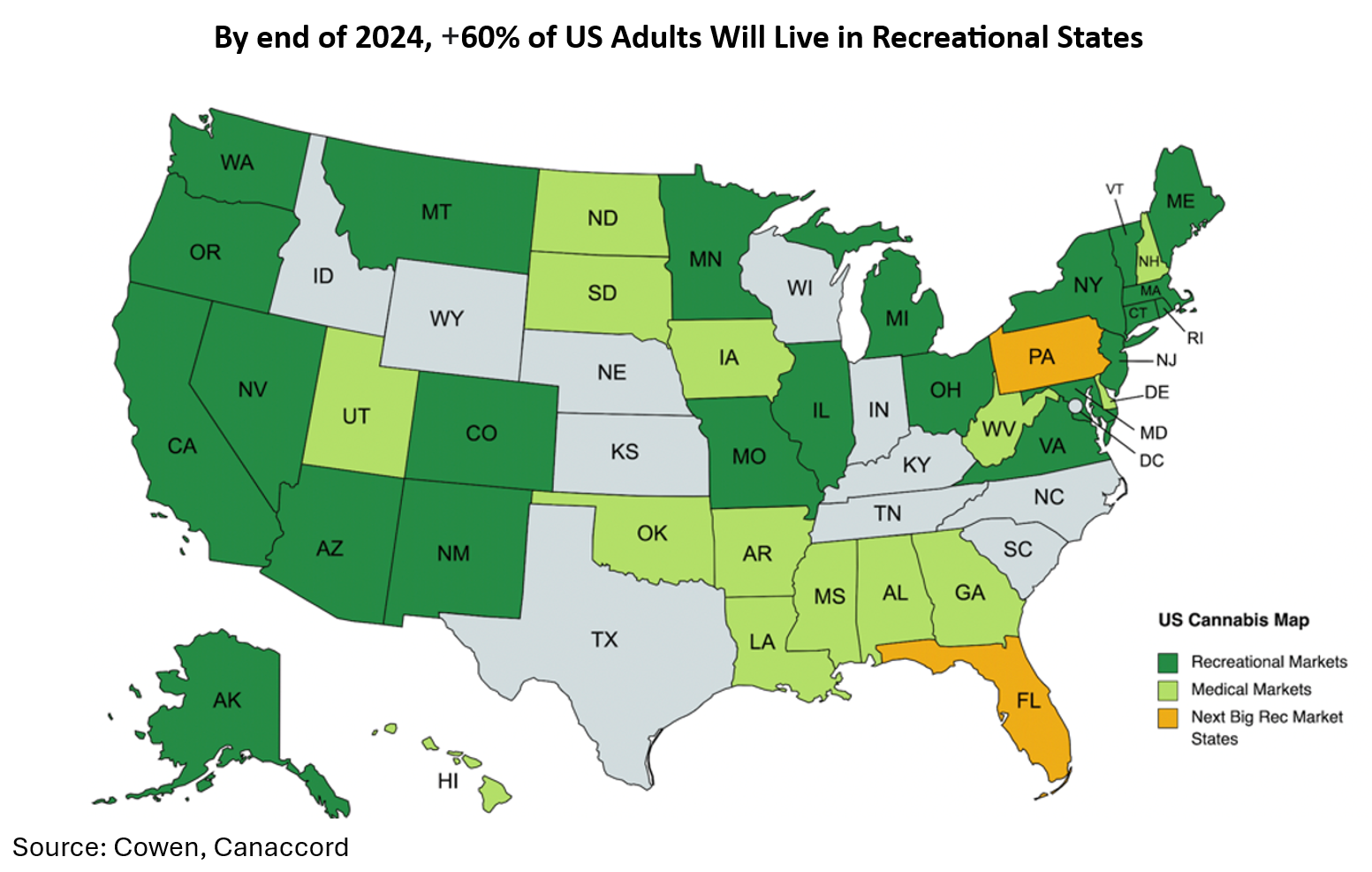

Now, that the language is approved and the vote is set to take place, what are the implications? For a successful vote, FL law requires 60% voter approval on any ballot and current polls suggest voter support is over 67%. Back in 2016, when medical was approved by a ballot initiative, the vote garnered 72% of the vote, so while not certain, there is optimism for a positive November vote. This is a major opportunity for an already significant recreational market. Florida is the 3rd most populous state in the US with 22 million people, with one of the largest medical cannabis programs in the US, already generating annual revenues of over $1.8 billion. If we use recent state transitions from medical to recreational and a similar growth step-up as Illinois, New Jersey and Maryland, the FL market could generate more than $3.5 billion in the first 12-24 months making it the 2nd largest cannabis market in the US, behind California. The upside in Florida could be even higher given the amount of tourists that visit the state each year.

This is also important for national support on federal cannabis reform, given that Florida is a state controlled by Republicans and borders many states that either have restrictive or limited medical cannabis programs. States such as Alabama, Georgia, Mississippi and Louisiana are likely going to see drivers come across the state border to buy cannabis that is not allowed in their home states. We have witnessed that in New Jersey where consumers drive from New York or Pennsylvania; we have also seen similar sales in Illinois where consumers come from Indiana, Missouri, Wisconsin and Iowa. Perhaps more importantly, having a rec legal neighbour in Florida may alter the nature of the debate over cannabis in these states as taxation revenue is lost, and voters see a functioning adult use market nearby. Beyond the obvious benefit of adding additional market size, having these deeply republican states become more cannabis friendly would improve the chances of additional federal reform.

Canadian Cannabis: European Expansion & Excise Tax Discussions

While not a large component of the funds’ holdings, we note that, Canadian Cannabis companies bounced off of multi-year lows based on legalization in Germany and the hope for an excise tax reduction here in Canada. The larger Canadian companies (Canopy, Aurora, Tilray) do have a presence in Germany, but there is little indication that the German market will develop into a profitable one the initial regulations seem designed to ensure that cannabis does not actually become a profitable business.(See below)

With respect to excise tax changes in Canada, we are unsure of the probability but it is a very high impact event. However, combining an excise tax reduction with stronger enforcement of excise tax collections and further bankruptcies accelerating the rationalization of the producer capacity, there is finally some reason for optimism for the Canadian LPs but we remain cautious. Within the space, we believe that Village Farms offers the best risk-reward setup. VFF is a low-cost producer that has been gaining market share across Canada over the last few years. Their valuation is reasonable with significant upside related to any positive excise tax changes as discussed above optionality to Europe and US.

German Legalization

A bill to legalize marijuana in Germany passed both houses of government; The Bundestag in February and Bundesrat in March with implementation beginning in April. The legislation has been debated in Germany and throughout Europe over the last few years. It was a hotly contested issue dealing with compliance with EU and UN regulations. Medical cannabis has been legal in Germany since 2017 with limited use as cannabis was listed as a narcotic, only prescribed by doctors and distributed through pharmacies to patients. The new laws remove cannabis as a narcotic which should allow for broader acceptance outside the pharmacy distribution model. The new laws will make possession and home cultivation legal as well as authorize social clubs to distribute marijuana to their members. We expect that changes will take time and that a functioning and investible adult-use market is still potentially years away.

However, on the medical side, there is potential for more near-term growth. Over the next several months the next steps of regulatory change are to take place around points of sale and distribution with large-scale pilot programs supplied by commercial growers. The question is will German legislators be able to create a framework for a medical cannabis market that will make it easier for doctors and pharmacists to prescribe medical cannabis and make it easier for patients to access regulated cannabis. The current market is limited in size due to very strict regulations, a lack of distribution networks and that cannabis was listed as a narcotic. By removing cannabis from the narcotics list, there is an opportunity for meaningful growth, but that will be dependent on the type of regulations that are put in place next. The extent to which telehealth will be allowed in the approval process is crucial to add meaningful participation to the legal market. In addition, removing cannabis from the narcotics list has the effect of reducing the apprehension of doctors to prescribe. Another important factor to consider is that with Germany, the largest and most influential country within the EU, taking this step towards recognizing cannabis in the medical market, opens the door for its EU neighbours to consider similar market opportunities.

COSTCO Wholesale (COST) Telehealth & GLP-1 Drugs

We continue to see strength in Costco’s (COST) healthcare focus. The company is in a top ten position given its wide variety of offerings within the alternative health fund mandate including organics, vitamins and supplements, gym equipment, eye care and pharmacy. Recently, the company announced that it is offering telehealth services focused on weight loss, through its partnership with Sesame. For members, COST is offering a weight loss program for $179 US and $195 US for non-members. The three-month subscription with Costco’s partner, Sesame, includes consultation, a treatment program, and access to GLP-1 drugs. Typically, this type of service accessed through traditional medical channels results in costs for GLP-1 drugs of approx. $1,000 US. This is a significant savings for members and could result in increasing access to a wider population of patients that would otherwise not be able to afford weight loss drugs.

Financial Results

TerrAscend (TSND) reported its Q4 results with significant growth in revenue to US$86.6 million, up 25% YoY vs Q4-22. The company did announce that despite the overall growth achieved, TSND did encounter short term challenges at its Maryland cultivation facility with new equipment installation resulting in a quarterly decline in sales of ~2.9%. It was the one blemish on an otherwise strong Q4-23 release. Overall wholesale revenues in its various state markets remain an engine of growth for the company and continue on a steep trajectory, growing 14% QoQ. One of TSND’s primary wholesale markets is New Jersey where the company increased market share with Q4 revenue growth of 17.5% allowing management to state that it holds the #2 branded market share in the state up from being third in Q3. On a gross margin basis in Q4, the Maryland equipment issue resulted in a reduced gross margin to 48.2%, down from previous quarters however still one of the top gross margins in the industry. Q4-23 adj. EBITDA was US$19.6 million(~22.6% margin), under the company’s previously issued guidance of US$23.8 million (27.5% margin).

For the year, the company announced revenues of $317 million, up 28% YoY with GM for the year of 50% in addition to a 77% improvement in adjusted EBITDA from continuing operations. TSND continues to be an efficient operator that we believe can continue to lead in select markets such as New Jersey, Pennsylvania and Michigan.

Noteworthy as cannabis investors await a decision from the DEA on re-scheduling cannabis and a resulting change in IRS Tax 280E, TSND announced that they are essentially following TRUL in re-filing tax returns for the last three years, looking to claim over $26 million in previous tax paid. They have also stated that ongoing 280E tax liabilities are going to be re-categorized on its balance sheet as long term liabilities awaiting further clarification.

Costco (COST) operates 875 warehouses, including 603 in the U.S. and about a dozen other countries, including Canada, Mexico, Japan and China. Market forces had the shares check back in March after a solid quarterly financial release omitted discussion of an annual membership increase. COST has strong brand recognition with a vast array of products along with a very loyal customer base as evidenced by its +90% annual membership renewal rate. The company has also shown resilience during both strong and weaker economic times, given that it provides daily household goods in bulk. Net sales for the quarter increased 5.7% to $57.33 billion, from $54.24 billion last year, while Q2-24 EPS was $3.92 beating consensus, up 19% YoY. Customer traffic continues to be strong despite fears related to consumer spending habits across North America, with growth in traffic of 5% in the quarter with an acceleration in February to 6% across all markets. Although the company does not break down sales of specific segments the CFO mentioned on the earnings call that the food court, pharmacy and optical centers were top performers in the quarter. We continue to see growth for COST as it has opportunities to add warehouses across North America, and in time, increase revenues with the first membership increase since 2017.

Recently UnitedHealth (UNH) has seen market pressure based on short-term concerns related to its Optum division as well as a slightly increased medical loss ratio (MLR) that seemed to be creeping higher. MLR is a measure of profitability and UNH has traditionally been able to be a leader in keeping MLR controlled. Q4 results met with investor concern and the equity promptly sold off more than what is typically seen for one of the bellwethers in healthcare and a component in the Dow Jones 30. This is a name we have owned and traded around our min and max targets. We had previously lightened up our position to our min back in the fall of 2023 as we allocated to other names where we felt better upside was available. When we saw the negative market reaction to the Q4 financial release we analyzed how to add to our position.

As we have previously explained to our Fund investor base, we employ various option strategies to assist our ability to either enter or exit specific names with discipline. Where we believe we are being well compensated through the premium income earned, we are writing cash secured puts on specific names we would like to own or to increase our exposure to such names in the Fund. We also write covered calls on names we feel have elevated valuations, and we are writing short strangles (puts and calls written on the same name but with different strike prices) on names we feel will trade range bound. Depending on the strike price chosen, all three strategies are neutral to slightly bullish strategies that allow us to generate option premiums or enter and exit positions at more attractive prices during periods of elevated volatility and anxiety/excitement.

For UNH, during the latest bout of weakness, we were looking to increase our exposure and felt it was important to highlight our recent approach. We currently had our minimum exposure in the Fund. From there our strategy is to take advantage of any price weakness and elevated volatility to write cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices. Over a period of time, when the stock price completes its bottoming process and begins to rise we wait and watch and then take advantage of price appreciation and elevated volatility to write covered calls as our position begins to near our maximum exposure. We essentially establish our own entry and exit points based on what volatility and market flow are telling us. Since inception of the option writing program, the Fund has generated option income of approximately $175,000 on UNH.

The earned option premium income has helped the net results in any event, appreciation or correction in stock price. Though far from risk free, cash secured puts and covered call writing has complemented our long only position and depending on the strike price chosen, both strategies are neutral to slightly bullish that allow us to generate option premium or use discipline to enter and exit positions at more attractive prices during periods of elevated volatility and anxiety/excitement.

Option Strategy

Since the inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately $4.94 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio in favor of names we prefer while generating approximately $14,000 in options income. We continue to write short dated covered calls on names we feel are range bound near term and from which we could receive above average premiums. We also continue to write short dated cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including Merck & Co. Inc. (MRK).

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

Statistical Analysis

| Ninepoint Alternative Health Fund | |

|---|---|

| Cumulative Returns | 61.4% |

| Standard Deviation | 27.3% |

| Sharpe Ratio | 0.17 |

1 All returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at March 31, 2024. The index is 70% Thomson Reuters Canada Health Care Total Return Index and 30% Thomson Reuters United States Healthcare Total Return Index and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: Cannabis sector risk; Concentration risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded fund risk; Foreign investment risk; Inflation risk; Market risk; Regulatory risk; Securities lending, repurchase and reverse repurchase transactions risk; Series risk; Specific issuer risk; Sub-adviser risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended March 31, 2024 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Alternative Health Fund 12/2023

- Alternative Health Fund 11/2023

- Alternative Health Fund 10/2023

- Alternative Health Fund 09/2023

- Alternative Health Fund 08/2023

- Alternative Health Fund 07/2023

- Alternative Health Fund 06/2023

- Alternative Health Fund 05/2023

- Alternative Health Fund 04/2023

- Alternative Health Fund 03/2023

- Alternative Health Fund 02/2023

- Alternative Health Fund 01/2023