Ninepoint Alternative Health Fund

March 2023 Commentary

Summary

In this month’s commentary, we discuss recent announcements that serve as a potential catalyst for US Multi-State Operators (MSO’s). Although the effects will take time to propagate through the market and ultimately be seen in share price appreciation, the recent announcement by TER announcing the progress achieved for their up-listing to the TSX has implications not just for the company but for MSO’s in general. Another item we discuss that has interesting implications for US federal cannabis laws involves the recent passage by the state of Kentucky to legalize cannabis for medical use. This is a change that has wider implications given its US Senators have had a history of dragging their feet on federal cannabis legislation. Further acceptance of cannabis use in society is also discussed with respect to changes implemented in the new collective bargaining agreement with the NBA and its players. On the healthcare front, we review the recent JNJ announcement involving the settlement related to talc related consumer products. We also highlight the clinical trial results of portfolio company EPRX. Finally, we emphasize that not all cannabis companies are created equal, and using a selective actively managed approach is the preferred route for long-term growth. In examining the financials of Fund holdings TER and VRNO, we detail and discuss important factors to be analyzed in 2023.

Commentary

March equity markets were hampered by uncertainty and volatility caused by liquidity issues in US regional Banks that create new concerns for investors as recessionary fears continue to grow. We are not debating whether all US regional banks are systemically important, that is not our point to address, but what is important to consider are the ramifications for investors in related financial businesses and asset classes as well as the wider implications of tighter credit conditions as regional banks pull back lending to bolster liquidity. There is also a wide range of opinions on the direction of US Federal Reserve policy for the balance of the year leading to a good mix of uncertainty on the part of retail investors.

Cannabis companies in the US continue to battle pricing pressures amid very tight capital conditions. While pricing pressure will impact every company in the space to some degree, the larger, better financed MSO’s will fare significantly better than the smaller, cash constrained operators. While we have seen some impact on margins in our portfolio companies, the effect on smaller players (not in the portfolio) is much more significant and we are beginning to see marginal producers exit the market. While challenging short-term, this attrition will leave the better capitalized MSO’s in a stronger position.

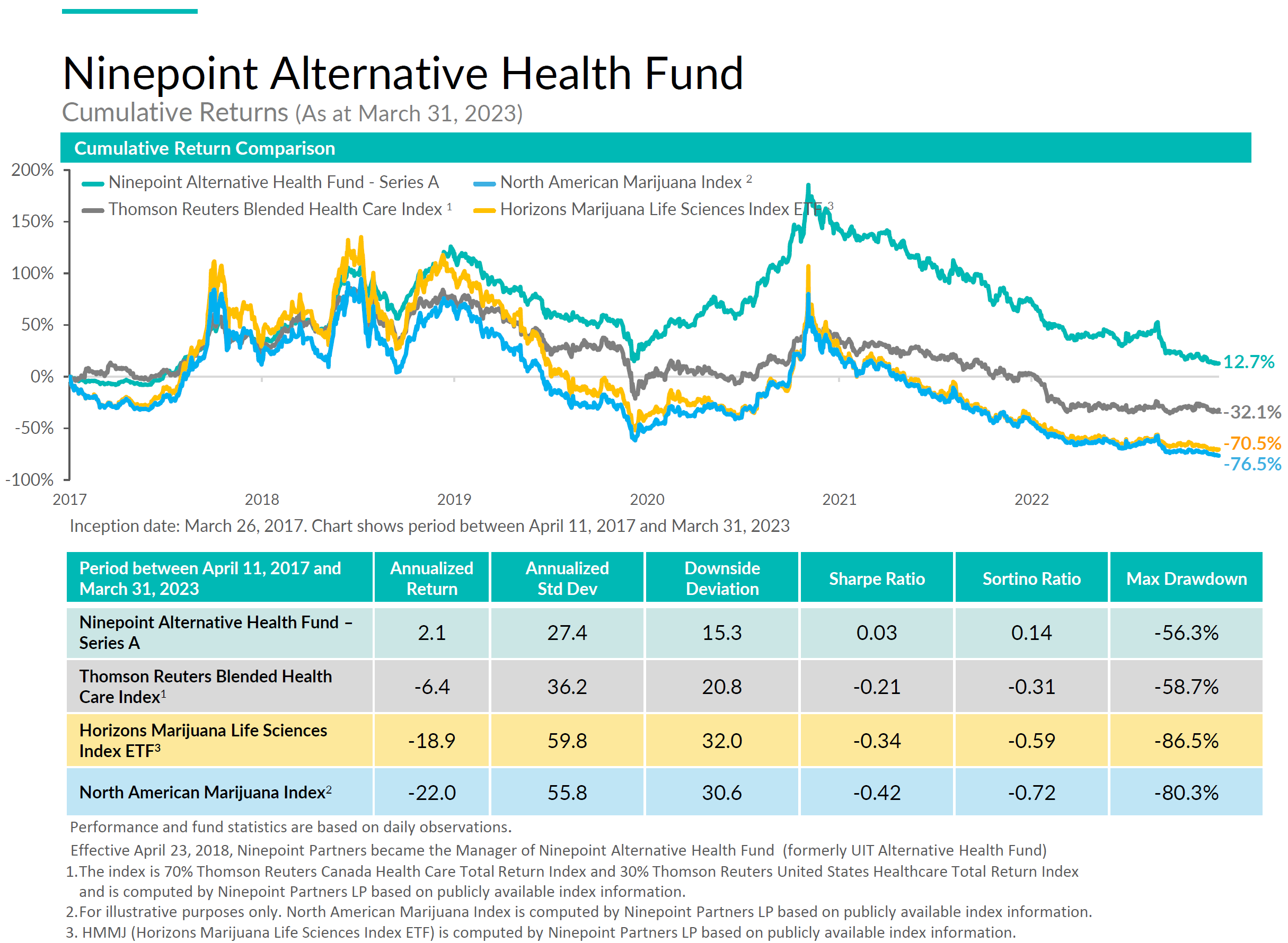

The Ninepoint Alternative Health Fund is a unique fund designed to provide exposure to the growing cannabis industry while investing in a range of healthcare, pharmaceutical and wellness companies that offer stability and long-term growth. Since its inception in 2017, the Fund has outperformed its benchmark and related cannabis indexes with our actively managed approach.

TSX Up listing for US Multi-State Operators (MSO’s)

On Tuesday, March 14th, Terrascend Corp (TER) reported that it has filed an application to up-list its shares from Canadian Securities Exchange (CSE) to the Toronto Stock Exchange (TSX). We believe that up-listing could be a significant catalyst for TER share price as it removes a key impediment to liquidity for TER shares as well as other MSO shares that trade on the CSE.

Why is this significant?

Given that TER disclosed the application, we believe they have likely received some type of assurance on an approval to up-list. To date, MSOs have only been allowed to list on the CSE or NEO exchanges in Canada and only OTC trading in the US. The CSE, where most of the US MSO’s are listed in Canada, has reduced capital requirements and limited shareholder board lot minimums relative to the TSX (and major US exchanges) that limit the acceptability for large institutions to trade securities. As a result, there is very little institutional trading of companies traded on the CSE.

Canadian Cannabis LPs vs US Multi-State Operator Trading/Liquidity

For example, if we look at the recent trading of Curaleaf (CURA) the largest US MSO by share count, it has an average daily volume of ~285k shares on the CSE and 1.03 million shares on the OTCQX (over the counter), whereas Tilray (TLRY), the largest Canadian LP by shares, has a daily average on the TSX of 750k shares and 10.6 million shares on the NASDAQ. While it is not comparable to the NASDAQ, access to the TSX is meaningful! It must be pointed out that currently due to preferable listing options for Canadian cannabis companies, their valuation multiples are significantly higher than US MSOs, despite the fact that many US MSOs have better EBITDA and operating cash flow metrics, something that with enhanced access to institutional support would result in higher share prices. (Note: trading volume as per Refinitiv 04-06-2023)

Current US Federal Legislative Delays

When we add the challenges that US MSOs have in listing their securities on major exchanges in the US on NASDAQ or NYSE, there has to date been minimal US institutional investment in the sector as well. We have written often on SAFE Banking, Cannabis re-scheduling and US federal legislative changes that would allow access to national banking and brokerage such as custodial services and trading, but to date that has not progressed.

Currently, the Biden Administration has told the Attorney General to examine the scheduling of cannabis within the Controlled Substances Act, which should be done within the next 12-18 months. There is also discussion from the Department of Justice to bring back some form of the “Cole Memo”, now to be called a Garland Memo. Originally named for Assistant Attorney General Cole during the Obama Administration, the Cole Memo stated that the Justice Department would not interfere in state legal cannabis businesses. The Cole Memo was rescinded during the Trump Administration. Recently Attorney General Garland has stated a “Cole Memo” is in the works.

To appease Institutional concerns about investing in federally illegal businesses, the TSX suggests a “ring fence” structure to prevent direct investment into US plant touching operations.

The TSX is a well-regarded exchange, indirectly owned by Canadian Banks, and has institutional trading from Canadian and US Institutions. Having the first US MSO listed on the TSX, would be a significant catalyst to add new shareholders to TER, and provide enhanced liquidity to the shares of TER while also offering a “re-rating” opportunity for additional well-capitalized US MSOs to also up-list to the TSX. If approved, we will be interested to see the type of structure that the TSX deems acceptable and how easily it might be replicated by other MSOs.

Kentucky Signs Medical Cannabis Law

At the end of March, Governor Andy Beshear (Democrat) of Kentucky, along with the State of KY Senate (controlled by Republicans) signed a medical cannabis bill into law enabling medical marijuana use and sale in KY starting in 2025. Kentucky becomes the 38th state to legalize medical cannabis within its borders. It’s interesting to note from a historical perspective that Kentucky used to be the largest exporter of cannabis back in the early 1900s when many pharmaceutical products contained THC.

Implications of this announcement are significant despite KY being a state with a population of just 4.5 million. The first positive is that with KY allowing medical cannabis sales, the US total addressable market (TAM) for cannabis now reaches close to 75% of the US population. A more subtle implication rests at the national level and the fact that KY has 2 U.S. Senators (both Republicans) and 6 U.S. Representatives that now have constituents within a medical cannabis market. At the top of the list is Senate Minority Leader Mitch McConnell who has not been a positive force for change toward adopting cannabis legislation at the federal level. We believe that taking this first step for KY is a pivot in the right direction at the national level.

The new state medical program has various qualifying conditions including chronic pain, PTSD as well as severe illnesses such as cancer, epilepsy, and MS. In addition, it includes any condition for which the University of Kentucky's research organization, Kentucky Center for Cannabis, deems appropriate. Details of the regulations should be finalized on or around July 1, 2024.

NBA and NBA Players Union Agreement on Cannabis

As a number of states establish legalized medical and adult-use markets, professional sports leagues have been gradually easing their decades old “zero tolerance policies” toward cannabis. The National Football League (NFL) has contributed capital for research projects examining the benefits of pain management related to cannabis. Last October, MLB and Charlotte’s Web Holdings, one of the best-known companies in the CBD industry, signed an agreement designating the Colorado company as the league’s first official CBD sponsor.

Now, a new collective bargaining agreement was negotiated between the National Basketball Association (NBA) and the NBA players association with one provision allowing players to invest in and promote cannabis companies. The deal still needs to be ratified by the players union and team governors. This is important as the current stance of the league previously penalized and suspended players for consuming marijuana in addition to preventing them from sponsorships or business opportunities. Currently, there are many former players that have invested in or operate cannabis businesses including Al Harrington, Chris Webber and Carmelo Anthony.

NBA players will now be able to consume legal cannabis products as they would be removed from the league’s drug testing program. This agreement is a major endorsement for the US cannabis industry in addition to potentially opening up a new source of investment capital for the industry.

Be Selective with US Cannabis Investments

The Fund has been underweight Curaleaf (CURA) and it is important to highlight some key points behind our decision. Over the last 9 months, CURA has released financial results with weaker sales and margins and has subsequently eliminated/reduced operations in Massachusetts, California and Colorado. Now, its streamlining is focused on New Jersey as detailed below.

CURA, having announced several closures of operations across the US, now plans to close one of its cultivation facilities in Camden County NJ, impacting 40 jobs, the company confirmed late in March. Management noted that it will be transferring its operations from the Bellmawr facility to its other cultivation facility in Winslow. This was an interesting announcement that may have caused recent weakness in trading of other US cannabis names, however upon closer examination this could be an issue specific to CURA rather than an industry or state market issue.

There are a few factors to consider. Although there is no granular state-level sales data from providers like BDSA, when reviewing the meeting notes from the February NJ Cannabis Regulatory Commission meeting, there are only 17 cultivation licensees, well below the US average of 31,000 people for each cultivation license. NJ stands at 197,000 residents for each of its only 17 operational cultivation licenses in the state. NJ is a limited license state with few operators servicing close to 10 million people. We have also recently seen top operators in the state announce Q4 financial results (TER and VRNO) both of whom reported stable pricing and margin growth in NJ. This is a time to be cautious in selling indiscriminately, instead focussing on those operators that are executing well despite the economic conditions. There is a report that CURA could be responding to a union vote by workers at the facility, closing it down before having the challenge of dealing with further wage hikes and labour demands. We continue to be underweight this name.

Health Care

Early in April, Johnson & Johnson (JNJ) had a strong day, reaching a 2-month high based on the announcement that the company has come to an agreement on an $8.9 billion offer to settle a decade long talc-related lawsuit. The case involved thousands of people who claimed certain JNJ products (including Johnson’s Baby Powder) caused asbestos related cancer. The settlement although a win for claimants clears up a significant amount of uncertainty for JNJ as it is in the process of splitting off its consumer health products business in an upcoming IPO, to be called Kenvue. The settlement removes an overhang on the stock and sets a 25-year timeline for payouts to claimants. If the courts approve the settlement, the agreement will resolve all current and future claims involving these JNJ products.

This month, we are highlighting a small cap healthcare holding in the fund, Eupraxia Pharmaceuticals (EPRX). EPRX is a clinical stage pharmaceutical company focused on the development of innovative delivery technology. Their most advanced product, which is currently in Phase II trials, targets osteoarthritis pain and inflammation through regulating the release of the active pharmaceutical (steroid) such that drug concentrations do not rise to levels that could harm knee cartilage. By modulating the steroid concentration through slower-release, Eupraxia believes a more constant drug level can be maintained, resulting in longer clinical effects and fewer side effects. Results from the phase II trial are expected in Q2. The key determinant for success is likely to be the duration of improvement. If the study shows a duration of over 18 weeks, the trial should be considered highly successful and we would expect significant rerating of the stock.

As per Raymond James, the TAM for knee osteoarthritis is large and growing, with $1.9 billion spent on knee OA therapeutics, expected to grow to $2.9 billion by 2025, with none of the current therapeutics being optimal.

Q4 US Cannabis Financial Results

Two of the Funds’ US cannabis positions announced Q4-22 financial results that evidenced sound execution, positive cash flows and resilience despite the increasingly challenging inflationary environment facing consumers.

Terrascend (TER) released a Q4-22 record net revenue of $69.0 million, an increase of 50.3% year-on-year and 4.2% quarter-on-quarter. During the quarter, the company generated wholesale revenue of $12 million led by its exclusive distribution deal with COOKIES in MI and NJ, while retail revenue was aided by the company’s August acquisition of the Pinnacle dispensary chain in MI. Gross Profit margin in Q4 was 44.6%, compared to 47.0% in Q3 2022, the decline driven by start-up costs in Hagerstown, MD and partial improvements in margin restoration from PA cultivation improvements. Adjusted EBITDA from continuing operations was $12.2 million, compared to $13.0 million in Q3 2022 while Q4 positive cash flow from operations reached $7.3 million compared to $1.5 million in Q3. Of note during the quarter, TER reduced indebtedness by $80 million saving roughly $10 million in annual interest costs.

For the year, TER generated $248 million in revenues, up 28% year-on-year with retail revenue from its dispensaries reaching $184 mm in FYE 22, driven by sales in NJ along with MI sales improvements from GAGE and Pinnacle. Gross Profit margin was 41.0% compared to 57.9% in 2021, the result of the PA cultivation facility retrofit and the resulting challenging market for wholesale in that state. TER announced a $311.1 non-cash impairment charge against goodwill for the Company's Michigan business with adjusted EBITDA from continuing operations of $38.8 million. During 2022, the company reported revenue growth in each quarter, while operational improvements were achieved in MI where that state’s operations are now cash flow positive and contributing to the bottom line. We see continued growth for TER in 23 from a top-line and profitability standpoint as new markets open for TER with its strong positioning in MD, with adult use anticipated to start in July. Combined with the MD opening, NJ continues to provide solid revenue growth and margin for TER with its exclusive COOKIES cultivation and distribution agreements governing operations in both MI and NJ. As TER Chair Jason Wild discussed on the Q4 call, there are interesting M&A opportunities on the horizon as well, where given the current state of capital markets, cannabis operations are available if a portion of their existing debt is covered, meaning no capital or dilution is required to add scale to the current business. This will be a dynamic to watch closely for those well-positioned in US cannabis.

A final point on TER leadership for the Fund is in its leadership with its application for listing on the TSX, discussed above which could provide much needed institutional exposure to not just TER, but to those MSOs that decide to list on the TSX in the coming months. As mentioned in the commentary above, this is a major catalyst to be considered for US cannabis names in 2023.

Verano Holdings (VRNO) announced Q4 revenue of $226 million, an increase of 7% year-on-year however decreasing 1% quarter-on-quarter. The top line was aided by the strength of adult use sales in New Jersey, in addition to increased retail contributions from recent Florida store openings. VRNO is a top two market share brand in NJ and has been able to generate solid sales and margins as NJ continues to offer more form factors and add dispensaries. Gross profit in Q4 was lower than Q3-22 at 54%, generating $103 million or 46% of revenue illustrating headwinds caused by inflationary pressures in addition to seasonal discounting that takes place in Q4 with Thanksgiving and Christmas sales pressures. Adjusted EBITDA reached $79 million or 35% of revenue while Cash Flow from Operations was $29 million while Free Cash Flow was $20 million.

For the year, revenue was $879 million, increasing 19% year-over-year while Adjusted EBITDA was 37% of revenue or $324 million while Cash Flow from Operations for the year was $94 million. Attention for 2023 is on gross margin management and positive cash flow generation. State markets such as NJ and new adult use markets in the northeast including CT and MD will generate additional traction as VRNO is well positioned in these markets. Total free cash flow for 2023 is estimated to be approx. $50 million to $75 million. Despite the strength in cash flow generation, VRNO currently trades at a low EBITDA multiple vs larger US cannabis MSOs at just 4.4x 2023 EBITDA forecast.

The important point that needs to be understood for leading US cannabis companies is their ability to generate free cash flow. Many of the names in our portfolio, GTI, TRUL, TER and VRNO are now in a position to moderate capital expenditure programs thereby allowing free cash flow to increase materially. This is in stark contrast to the leading Canadian cannabis companies that are not able to generate free cash flow from cannabis sales. Not all cannabis names are created equal and it is important to emphasize being selective, choosing those leading names that are well positioned in unique markets, with leading positions, able to take advantage of their leading positions.

Option Strategy

Since the inception of the option writing program in September 2018, the Fund has generated significant income from options premium of approximately $4.71 million. We will continue to utilize our options program to look for attractive opportunities given the above-average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio in favour of names we prefer while generating options income. We continue to write covered calls on names we feel are range bound near term and from which we could receive above average premiums which included Eli Lilly and Co (LLY), Tilray Brands Inc. (TLRY), and UnitedHealth Group Inc. (UNH). We also continue to write cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including Tilray Brands Inc. (TLRY) and Bristol-Myers Squibb Co (BMY).

The Ninepoint Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

Ninepoint Alternative Health Fund - Compounded Returns¹ as of March 31, 2023 (Series F NPP5421) | Inception Date - August 8, 2017

| MTD | YTD | 3MTH | 6MTH | 1YR | 3YR | 5YR | INCEPTION (ANNUALIZED) |

|

|---|---|---|---|---|---|---|---|---|

| FUND | -3.7% | -8.7% | -8.7% | -13.4% | -34.7% | -3.7% | -2.5% | 4.1% |

| TR CAN/US HEALTH CARE BLENDED INDEX | -6.2% | 3.7% | 3.7% | -0.3% | -32.6% | -10.3% | -12.3% | -7.3% |

Statistical Analysis

| FUND | TR CAN/US HEALTH CARE BLENDED INDEX | |

|---|---|---|

| Cumulative Returns | 25.5% | -34.8% |

| Standard Deviation | 28.1% | 29.9% |

| Sharpe Ratio | 0.1 | -0.3 |

1 All returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at March 31, 2023. The index is 70% Thomson Reuters Canada Health Care Total Return Index and 30% Thomson Reuters United States Healthcare Total Return Index and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: Cannabis sector risk; Concentration risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded fund risk; Foreign investment risk; Inflation risk; Market risk; Regulatory risk; Securities lending, repurchase and reverse repurchase transactions risk; Series risk; Specific issuer risk; Sub-adviser risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended March 31, 2023 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Alternative Health Fund 12/2023

- Alternative Health Fund 11/2023

- Alternative Health Fund 10/2023

- Alternative Health Fund 09/2023

- Alternative Health Fund 08/2023

- Alternative Health Fund 07/2023

- Alternative Health Fund 06/2023

- Alternative Health Fund 05/2023

- Alternative Health Fund 04/2023

- Alternative Health Fund 02/2023

- Alternative Health Fund 01/2023