Ninepoint Alternative Health Fund

April 2023 Commentary

April Commentary

April was a volatile month for equity markets as the fate of US Regional Banks continued to weigh on investor sentiment. At the same time, continued US Federal rate hikes, combined with inflationary pressures were eating into consumer purchases leading to many companies to reduce 2023 forecast earnings. As we have mentioned in past commentaries, the “trade down” is continuing in purchases with consumers searching for value instead of convenience or brand awareness. With this backdrop in mind, we are heartened by the resiliency of the healthcare sector generating Q1 financial results that beat analyst estimates while 2023 forecasts are getting upgraded based on demand for health services.

In this month’s commentary we discuss the spin-out of Johnson & Johnson’s (JNJ) consumer healthcare company Kenvue (KVUE) and the positive light that this new company brings to the consumer health sector. A Fund holding that should gain traction based on the awareness of KVUE is Perrigo (PRGO), a provider of health and wellness products for consumers including white label products in various categories including skin care, cough and cold, oral hygiene and infant formula. We also continue to point to strong demand in the alt milk category supporting Fund holding Sunopta (STKL). On the US cannabis front, we cover some of the newest adult use state markets and their early growth as well as the latest legislative proposals out of Washington as Congress debates the newest version of the SAFE Banking Act. Finally, we go through the Q1-23 financial results of various Fund holdings highlighting our largest cannabis holding Green Thumb Industries (GTI) and their discussion on share buybacks during their Q1 earnings call; as well as the strength from top ten healthcare names Johnson & Johnson (JNJ), Abbott Labs (ABT), and UnitedHealth Group (UNH).

This is a sector fund. It's important to understand how underlying indexes performed in the relevant sector so that investors can compare our performance to a relevant benchmark. Our goal continues to be able to outperform the relevant benchmark with our actively managed strategy.

JNJ Spins Out Consumer Health Division in IPO

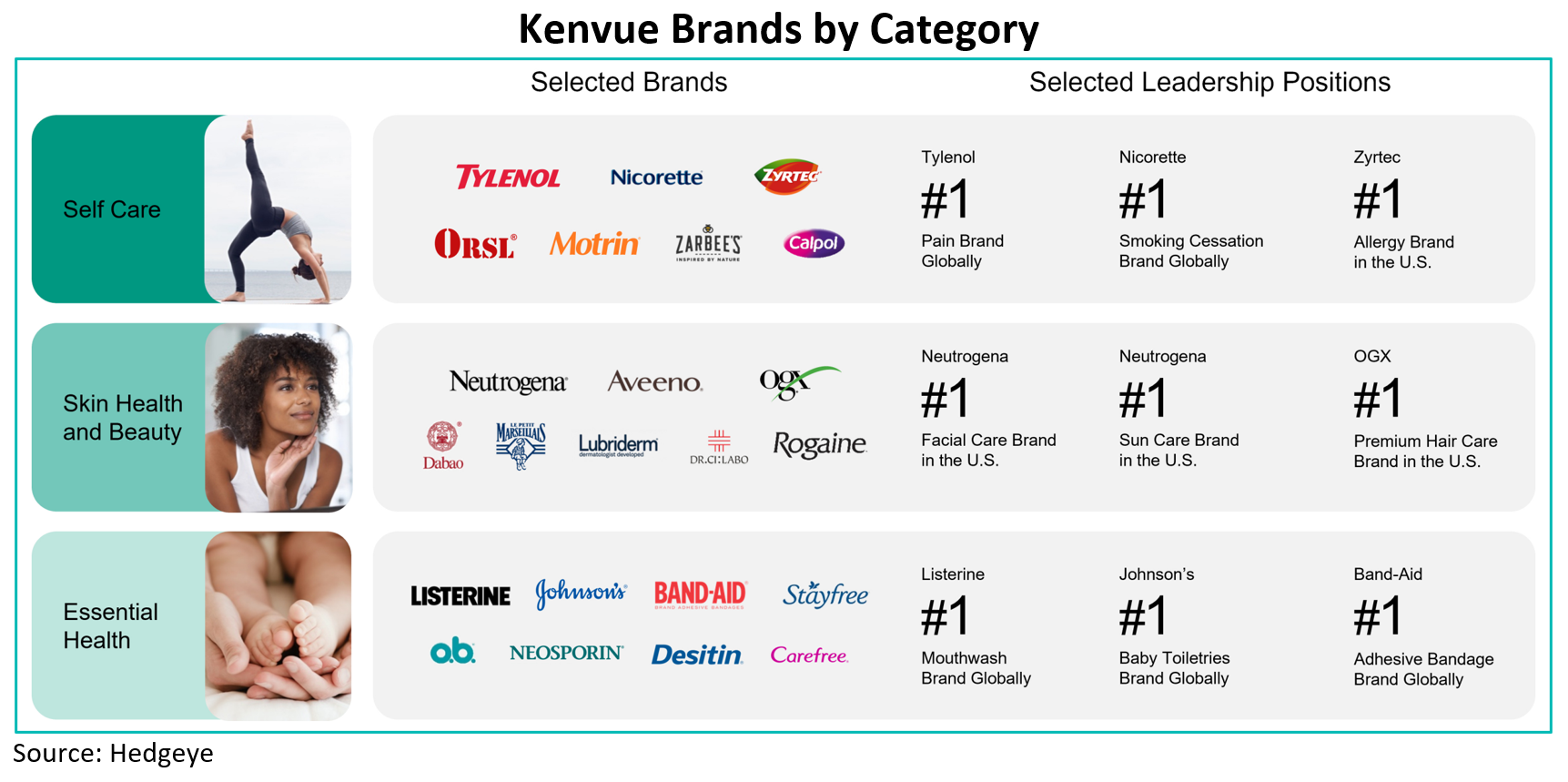

Johnson & Johnson's (JNJ) consumer health unit, Kenvue, began trading on May 4th setting up the creation of a global consumer health company with leading brands including Band-Aid, Tylenol, Johnson’s Baby, Aveeno, Listerine, and Neutrogena. Think of this new separate entity as the Proctor & Gamble (PG) of the consumer health industry. The proposed $3.5B IPO would value the consumer health spinoff at $40B. Kenvue will be the world’s largest pure-play consumer health company in the $369B industry with well-known brands including Tylenol, Band-Aid, Listerine, and Neutrogena. Each of its ten brands had $400 million or more in sales. Seven of its brands are market share leaders in their respective categories globally.

The consumer division of JNJ was responsible for generating net sales of $15.1 billion in 2021, up from $14.5 billion in 2020, according to its filing with the U.S. Securities and Exchange Commission (SEC). In Q1-23, J&J’s consumer health business reported about $3.8 billion in sales, a growth of 7.4% over Q1-22 primarily driven by over-the-counter products like Tylenol and skin health products under brands like Neutrogena and Aveeno.

JNJ’s decision to separate its consumer health company follows a trend by other conglomerates.

In the health/pharma/medtech space undergoing similar transitions to enhance liquidity and value for shareholders, while providing capital to the parent company, in this case, JNJ. Companies such as Merck (MRK), Sanofi, Pfizer (PFE) and GlaxoSmithKline (GSK) have all completed similar transactions, (although not as large as the JNJ spinoff) over the last few years. J&J will continue to own approximately 90% of the voting power of the company's shares upon completion of the offering.

Alt Milk Demand vs Dairy Milk

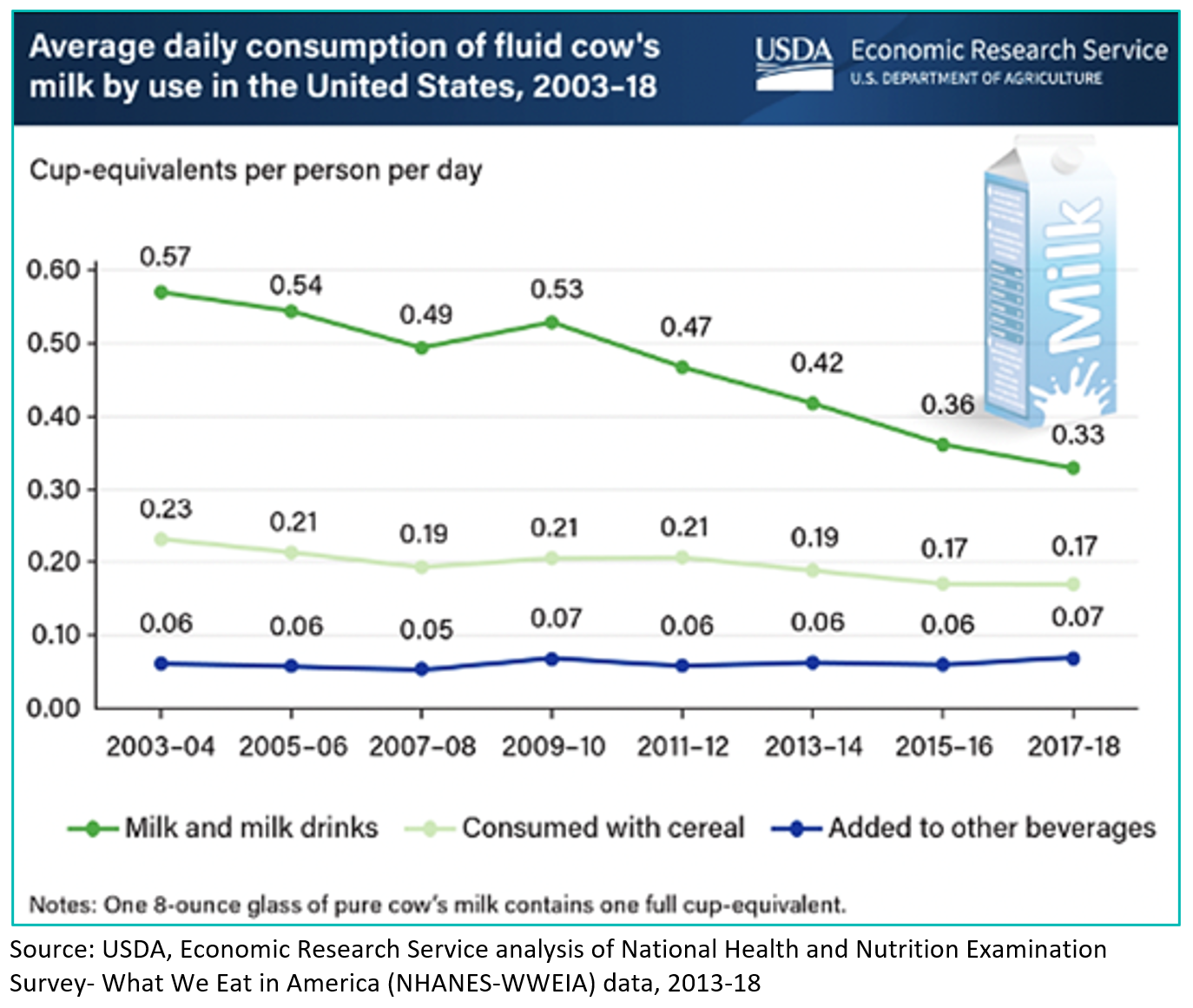

The USDA has stated that milk consumption has been falling since the 1940's and the decade of 2010’s witnessed the fastest rate of change down comparing each of the last six decades. Americans' consumption of cow's milk has been falling since the 1940s. And according to the USDA per capita consumption declined "at a faster rate during the 2010s than in each of the previous six decades." A recent report from CIRCANA shows that in 2022 consumption patterns among the 18-25 demographic (Gen Z) purchased 20% less cow's milk than the national average, replacing dairy milk with plant-based alternatives. In response to the declining demand amongst this key demographic, the dairy farmers of America have been attempting to add high-profile athletes and entertainers to their roster of advertising muscle. But as we saw in 2010, not even a dairy campaign featuring Taylor Swift could change the consumption patterns of this age group.

US Cannabis Developments

Maryland Update: Recreational Sales Begin July 1, 2023

The Maryland House and Senate Passed a Bill to Implement Adult-Use Cannabis Sales by July 1, 2023. The legislation details that the state will regulate the new adult-use market with recreational sales subject to a 9% sales tax, while medical sales would remain exempt from sales tax. Existing medical dispensaries will be allowed to begin sales as early as July 1. Companies are allowed to own a maximum of 4 dispensaries while a statewide license cap of 300 dispensaries, 100 processors, and 75 cultivators has been established. This cap will assist the state in offering a balance that is good for consumer choice while also good for businesses limiting the number of locations and competitors. The estimates are the MD could be a strong state given annual tourism combined with bordering states such as PA and WV that are not open to recreational sales. Companies in the Fund’s portfolio that have leverage to this new state market include Green Thumb Industries (GTI) Terrascend (TER), Trulieve (TRUL) and Verano Holdings (VRNO).

Missouri Growth Experiencing Fastest State Ramp Up in Sales

Missouri reported that total statewide cannabis sales reached US$126.2M, up 22.6% MoM. The new adult-use market is experiencing one of the fastest ramp ups from a new recreational state launch with adult use sales reaching US$93.5 million in just two months. What is also noteworthy is that medical sales continued to grow, despite new competition from adult-use sales.

SAFE Banking 2023

For the eighth time, SAFE Banking has been introduced to both the House of Representatives and the Senate. What is different this time is that both the House and Senate have brought the bill to their respective members at the same time in addition to being focused solely on banking. The external issues previously added to this legislative proposal stalling the legislation included social equity provisions, federal pardons for cannabis related crime and interstate commerce.

We note that the Senate version of the new SAFE Banking proposal already has 40 sponsors including 5 Republicans and Senate Majority Leader Chuck Schumer (D) who has previously not been supportive, instead focused on competing legislation (the CAOA) that had no chance of passing. In addition, a more substantive positive this time is the report (as at May 5th) that Senate Banking Committee Chairman Sherrod Brown (who also previously did not support SAFE Banking) stated that the Senate Banking Committee could begin hearings on SAFE Banking as early as May 11th.

We understand investors have learned not to bet on Washington. What we want to highlight is the potential for SAFE combined with an update to the Cole Memo; rescheduling cannabis on the Controlled Substances Act (CSA) brought by President Biden in October, in addition to the uplisting of US MSOs to the Toronto Stock Exchange (TSX) could all lead to additional investor acceptance, especially on the part of institutional investors. The lack of access to institutional investors in our opinion is one of the primary reasons that MSOs, despite the strong cash flow of select names, have depressed multiples and underwhelming share price performance over the last 18-24 months. Individually, none of these items would be transformational for the cannabis sector but each of them would be incrementally positive in terms of attracting new capital to the sector. With the severely depressed trading prices in the sector, slight changes in sentiment have outsized effects on the share prices.

Financial Results

Green Thumb Considers Share Buybacks

Green Thumb Industries (GTI) was the first US multi state operator (MSO) to release Q1-23 results. The company produced impressive Q1-23 results, beating expectations while also exceeding its Q4-22 record-breaking operating cash results. GTI is one of the Funds’ top holdings and continues to outperform relative to analyst estimates as well as outperforming relative to its competitors.

Q1 revenues increased 2% YoY to $249 million USD with strong retail revenues reaching $188.8 million, up 9.4% YoY with states including RI and NJ contributing outsized performance. Same store sales (SSS), stores open at least 12 months, increased 6.3% YoY on a base of 73 stores, while wholesale revenues increased 4.3% YoY. At a time when consumers are stretched due to inflationary head winds along with price compression in the sector, GTII grew gross profit to $124.7 million or 50.2% of revenue while maintaining its margin from Q1-22 of 50.7%. Adjusted earnings before interest taxes and depreciation (EBITDA) increased to $76 million or 30.7%, ahead of consensus at $74 million. Cash flow from operations is $75 million in the first quarter with GAAP net income of $9 million or $0.04 per basic and diluted share. During the earnings call, management was asked if it considered using its strong cash flow generation capabilities to consider share buybacks. Company founder Ben Kovler stated that “nothing is off the table”, the company would need to achieve an annual cash flow of over $300 million to consider such a move. In 2022, GTI generated excess cash flow (after interest and 280E tax payments) of $160 million. During 2023, GTI should see growth from several adult-use markets such as MD, CT, and RI that support sequential growth.

GTI’s balance sheet is sound with cash levels at $185 million while debt is a manageable $250 million with a coupon of 7%. This moderate debt level combined with cash generation capability gives GTI the optionality to make investments or select M&A at a time when most of its competition is focused inward with higher debt levels and reduced cash flow generation. In 2023, management is focussed on opening 15 additional dispensaries across its network focussing on state markets such as FL, PA, NV, VA and MN. Despite strong execution and growing market opportunities, its shares continue to trade in-line with its MSO peers at 6.0x EV/2023e EBITDA.

Strong Healthcare Operating Results in Q1-23

At a time when many companies and sectors are adjusting forecasts downwards due to recessionary fears, the healthcare sector, as stated in previous commentaries has legs in this otherwise weakening Q1-23 earnings season. Many healthcare companies are releasing Q1 23 results that are beating estimates while we note the false narrative that suggests that now that COVID is over, there is less need for testing, potentially reducing earnings per share for companies in the healthcare space. We are seeing strong Q1-23 results for our leading healthcare names including JNJ, ABT, UNH.

Johnson & Johnson (JNJ) released Q1-23 results that illustrate an acceleration of its business, a large beat relative to analyst expectations in addition to a strong forecast for the balance of 2023. Management that stock performance has not matched operational strength, focusing on its med-tech division leadership is a key driver in 2023. Some of the key factors that are assisting JNJ with enhanced earnings per share in 2023 include reduced labour costs combined pent-up demand for pharmaceutical and med-tech services. In addition, we believe the pending IPO of KENVUE, JNJ’s consumer health business spin-off will add significant value to shareholders.

JNJ, considered a bellwether for the health care sector, reported Q1-23 revenue of $24.75 billion representing growth of 5.6% over the same quarter last year and handily beating analyst estimates of $23.67 billion. Adjusted earnings per share in Q1 was $2.68 vs. analyst estimates of $2.50. By all measures, Q1 was a big beat for JNJ! The company reported $13.4 billion in pharmaceutical sales, up more than 4% over Q1-22. Management noted the increase was driven by Darzalex, its treatment for multiple myeloma. Also, a significant contribution came from Stelara, used to treat a number of immune-mediated inflammatory diseases. Also strong were medical devices generating close to $7.5 billion in revenue, up 7.3% vs Q1-22. For the year, JNJ forecasts revenues of $97.9 billion to $98.9 billion, approx. $1 billion higher than previous management guidance provided in January. The company also raised its full-year adjusted earnings outlook to $10.60 to $10.70 per share, from the previous forecast of $10.45 to $10.65. J&J also announced recently that its board has approved a 5.3% quarterly dividend increase, to $1.19 per share.

Abbott Laboratories (ABT) announced Q1-23 results illustrating that medical devices have stronger demand and higher margins than COVID tests. Now operating in the post pandemic period, healthcare devices are showing the strength of demand leading ABT to forecast lower earnings from COVID testing, while full-year EPS guidance is unchanged due to an increased outlook for its medtech business.

Sales in Q1 were $9.75 billion beating consensus of $9.67 billion, although revenue decreased by 18.1% from the same period last year, due to a drop in demand for rapid Covid testing. Q1-22 was the peak of the Omicron period leading to an all-time high for Covid-testing sales. To replace the loss of earnings related to COVID testing, there is a recovery in demand for surgical procedures and medical devices. Despite the sales reduction, Q1-23 adjusted earnings was $1.03/share beating expectations for $0. 99 cents. Q1 saw medical device sales growth of 12.4%, pharmaceuticals up 11.1% and nutrition up 10.3%. In diabetes, sales of ABT’s body-worn glucose monitor “FreeStyle Libre” reached $1.2 billion with 50% growth in the U.S. market. ABT continues to project full-year EPS from continuing operations of $4.30-$4.50/share illustrating a strong outlook for the core medical device business.

UnitedHealth Group (UNH) is one of the largest managed care providers in the United States offering a range of medical and health services, including individual and group health plans, Medicaid and Medicare policies, dental and vision benefits as well as a host of pharmacy and other non-surgical procedures. The company released stronger-than-expected Q1-23 results, with record revenues, led by the double-digit gains from its Optum unit. Optum services reach over 100 million patients, providing data analytics, managed care services and pharmacy care services for employers, patients and hospitals. Revenues rose 14.7% to $91.9 billion, beating analysts' estimates of $89.76 billion, with Optum revenues rising 25%. UNH generated earnings per share (EPS) of $6.26 vs consensus EPS of $6.17 per share. With the stronger-than-anticipated Q1 results, the company adjusted its fiscal year EPS forecast to $24.50-$25.00 from the prior range of $24.40-$24.90.

Option Strategy

Since the inception of the option writing program in September 2018, the Fund has generated significant income from options premiums of approximately $4.73 million. We will continue to utilize our options program to look for attractive opportunities given the above average volatility in the sector as we strongly believe that option writing can continue to add incremental value going forward.

During the month we used our options strategy to assist in rebalancing the portfolio in favor of names we prefer while generating approximately $24,000 in options income. We continue to write covered calls on names we feel are range bound in near term and from which we could receive above average premiums which included Tilray Brands Inc. (TLRY). We also continue to write cash secured puts out of the money at strike prices that offered opportunities to increase our exposure, at more attractive prices, to names already in the Fund including Merck & Co. Inc. (MRK) UnitedHealth Group Inc. (UNH), and Bristol-Myers Squibb Co (BMY).

The Ninepoint Alternative Health Fund, launched in March of 2017 is Canada’s first actively managed mutual fund with a focus on the cannabis sector and remains open to new investors, available for purchase daily.

Charles Taerk & Douglas Waterson

The Portfolio Team

Faircourt Asset Management

Sub-Advisor to the Ninepoint Alternative Health Fund

Ninepoint Alternative Health Fund - Compounded Returns¹ as of April 30, 2023 (Series F NPP5421) | Inception Date - August 8, 2017

| MTD | YTD | 3MTH | 6MTH | 1YR | 3YR | 5YR | INCEPTION (ANNUALIZED) |

|

|---|---|---|---|---|---|---|---|---|

| FUND | 1.6% | -7.2% | -3.8% | -19.6% | -25.5% | -5.6% | -2.3% | 4.3% |

| TR CAN/US HEALTH CARE BLENDED INDEX | 5.1% | 8.9% | 1.5% | 0.6% | -22.6% | -11.7% | -11.2% | -6.4% |

Statistical Analysis

| FUND | TR CAN/US HEALTH CARE BLENDED INDEX | |

|---|---|---|

| Cumulative Returns | 27.6% | -31.4% |

| Standard Deviation | 27.9% | 29.8% |

| Sharpe Ratio | 0.1 | -0.3 |

1 All returns and fund details are a) based on Series F units; b) net of fees; c) annualized if period is greater than one year; d) as at April 30, 2023. The index is 70% Thomson Reuters Canada Health Care Total Return Index and 30% Thomson Reuters United States Healthcare Total Return Index and is computed by Ninepoint Partners LP based on publicly available index information.

The Fund is generally exposed to the following risks. See the prospectus of the Fund for a description of these risks: Cannabis sector risk; Concentration risk; Currency risk; Cybersecurity risk; Derivatives risk; Exchange traded fund risk; Foreign investment risk; Inflation risk; Market risk; Regulatory risk; Securities lending, repurchase and reverse repurchase transactions risk; Series risk; Specific issuer risk; Sub-adviser risk; Tax risk.

Ninepoint Partners LP is the investment manager to the Ninepoint Funds (collectively, the “Funds”). Commissions, trailing commissions, management fees, performance fees (if any), and other expenses all may be associated with investing in the Funds. Please read the prospectus carefully before investing. The indicated rate of return for series F shares of the Fund for the period ended April 30, 2023 is based on the historical annual compounded total return including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation by anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Prospective investors who are not resident in Canada should contact their financial advisor to determine whether securities of the Fund may be lawfully sold in their jurisdiction.

The opinions, estimates and projections (“information”) contained within this report are solely those of Ninepoint Partners LP and are subject to change without notice. Ninepoint Partners makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Ninepoint Partners assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Ninepoint Partners is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Ninepoint Partners. Any reference to a particular company is for illustrative purposes only and should not to be considered as investment advice or a recommendation to buy or sell nor should it be considered as an indication of how the portfolio of any investment fund managed by Ninepoint Partners is or will be invested. Ninepoint Partners LP and/or its affiliates may collectively beneficially own/control 1% or more of any class of the equity securities of the issuers mentioned in this report. Ninepoint Partners LP and/or its affiliates may hold short position in any class of the equity securities of the issuers mentioned in this report. During the preceding 12 months, Ninepoint Partners LP and/or its affiliates may have received remuneration other than normal course investment advisory or trade execution services from the issuers mentioned in this report.

Ninepoint Partners LP: Toll Free: 1.866.299.9906. DEALER SERVICES: CIBC Mellon GSSC Record Keeping Services: Toll Free: 1.877.358.0540

Related Funds

Historical Commentary

- Alternative Health Fund 12/2023

- Alternative Health Fund 11/2023

- Alternative Health Fund 10/2023

- Alternative Health Fund 09/2023

- Alternative Health Fund 08/2023

- Alternative Health Fund 07/2023

- Alternative Health Fund 06/2023

- Alternative Health Fund 05/2023

- Alternative Health Fund 03/2023

- Alternative Health Fund 02/2023

- Alternative Health Fund 01/2023